Unfortunately, many scammers, still exist in the crypto industry. Investors in pursuit of easy money often forget to check the projects thoroughly. Moreover, they fall for scammers’ baits. We collected high-profile cases of fraud, as well as tips on how to avoid investing in such projects.

Eros.vision

Let's start with the "hottest" crypto scam. The project positioned itself as a blockchain service for sexual services. Eros.vision was supposed to become a marketplace for the oldest profession.

Developers promised full anonymity of users, a convenient rating system and a protection from deception. When asked about the legality of such a project, they responded that the payment of tokens would help to avoid charges of illegal activities.

However, the project turned out to be just another fraudulent scheme. Its creators collected 7,400 bitcoins (about $20M) in July 2017. Soon after they announced the domain problems, shifted the start date of work and then broke off the connection with investors.An investigation of one of the Reddit users showed that the developers' accounts on LinkedIn, GitHub and Bitcointalk were fake. The domain was also purchased a week before the ICO, and the white paper was copied from another project. Overall, all the signs of fraud were obvious. Investors should be attentive, and not chase the unusualness or creativity of the project.

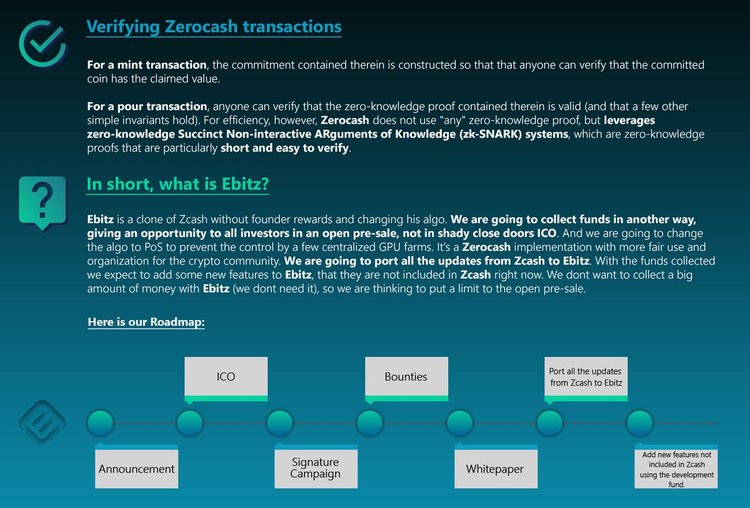

Opair & Ebitz

The purpose of the Opair project was to create a multifunctional decentralized platform that provides banking services.

Its developers promised to issue decentralized debit cards, which would allow the use of currency on day-to-day basis. Users have been promised various benefits, such as a high transaction speed and a crowdfunding platform for any innovative idea.

As a result, the project was one of the first major fraud cases in the crypto industry. Accounts of the leaders on LinkedIn, were filled clearly in a hurry, raised suspicions among potential investors. Scammers collected 1500 bitcoins (approximately $1M according to the August 2016 rates) and disappeared with all the money.

After some time, they tried to crank the same trick once again. Ebitz project sought to cash in at the expense of the popularity of anonymous cryptocurrency ZCash. However, this time the crypto community quickly revealed the scammers. It is worth noting that they made a silly mistake by using the same IP in both projects.

PayCoin

The project received such a scandalous fame that, perhaps, any member of the crypto community has heard of the PayCoin. It was a real classic scam.

The creator of the project, Homero Joshua Garza described PayCoin as a world currency capable of defying bitcoin. Before the creation of PayCoin, scammers rented and sold virtual Hashlet miners. This activity even formed a loyal audience around the company Geniuses at Work Corporation (GAW). However, the project with the miners began to die, and the team decided to transfer users from the mining of third-party altcoins to their own coins. PayCoin was invented just for these purposes.

Investors were promised to invent a breakthrough technology, provide bank’s support and give the opportunity to make free and fast payments around the world. PayCoin attracted miners’ attention, as the company has proved itself well before.

However, the founders did not make the promised partnerships with any of the banks happen. In addition, no innovations were created. The coin quickly dropped in its price and users began to file collective claims. Regulators, including SES, were interested in the project. After years of litigation, in the beginning of 2018, the head of GAW was ordered to pay $10M, although investments in the project from various sources amounted to more than $54M.

OneСoin

Another world scale fraud. In fact, this project is an example of a financial pyramid, which is covered by a cryptocurrency. OneCoin had no technological base, development plan or technical documents. But at the same time the project was able to attract investments from ignorant consumers from around the world.

The OneCoin project was initially positioned as a highly profitable cryptocurrency, in which investors made a profit not only from the growth of the asset, but also for attracting new participants. The project was organized by a Bulgarian citizen Dr. Ruja Ignatova. Scammers did not want to repeat the mistakes of their predecessors, so they made a list of difficult moments and developed a strategy for circumventing them. The company sold training programs on trading, mining and successful life. The project produced textbooks, presentations and other related products, as well as OneCoin tokens.

Fortunately, OneCoin met a strong resistance from the governments of different countries. For example, the UK Financial Conduct Authority issued an official warning that it considers OneCoin to be a fraudulent scheme using network marketing.Finally, regulators and banks in Italy, Germany, Hungary, Belize, Thailand and other countries banned the OneCoin trade and warned users against contacting this company. As a result, its organizers were detained.

PinCoin and iFan

A very large-scale fraudulent ICO has already happened in 2018. Startups iFan and PinCoin, owned by the Vietnamese company Modern Tech, deceived about 32 thousand investors and fraudulently received about $660M. Most of the victims were Vietnamese citizens.

A Vietnamese company ModernTech launched two ICOs and stated that their tokens comply with the ERC-20 standard. iFan was supposed to become a social network for celebrities and their fans, while PinCoin was presented as a project for the creation of an economy 2.0, development of the blockchain and cryptocurrencies.

Both ICOs passed under the scheme of a financial pyramid. Customers received their interest for investing money and bringing friends. However, soon ModernTech stopped paying dividends in fiat money and invited investors to receive rewards in tokens. Clients staged a demonstration at the company's office and demanded the return of their funds. However, it turned out that scammers left the office about a month ago. The funniest thing is that the websites of both projects are still up.

Despite the fact that numerous fraudulent schemes are now widely heard of, people continue to give their money to scammers. Unfortunately, the idea of a rapid enrichment still attracts potential investors. But many ICOs can be quite easily checked for it.

Here are a few tips:

- Thoroughly check the white paper. You can check the originality of the document on the service of antiplagiarism

- Make sure you have a prototype product or code posted on a public resource such as github.com.

- Analyze the economy of tokens. Also carefully check the documents for the discrepancy between the number of tokens in different sections

- Find and verify the personal accounts of the funders on social networks and do not be afraid to ask them more additional questions. Also communicate with the project community at bitcointalk.org and reddit.com

- Consult with experienced investors

By Ekaterina Ulyanova