Abu Dhabi Global Market (ADGM), an international financial center, launches a“crypto asset regulatory framework” that is to regulate crypto activities undertaken by all in the ADGM, including exchanges, custodians, and other intermediaries.

Having asked the public for their opinion of this endeavor in May, the Financial Services Regulatory Authority (FSRA) received positive feedback, due to the “comprehensive nature of the proposed regulatory framework.”

Addressing a range of worries, the framework focuses on “risks associated with crypto asset activities, including risks relating to money laundering and financial crime, consumer protection, technology governance, custody and exchange operations.”

Richard Teng, CEO of FSRA asserts:

“By introducing a comprehensive and best-in-class regulatory framework, the FSRA is taking a leading role in instilling proper governance, oversight and transparency over crypto asset activities, positioning ADGM as a destination of choice for crypto asset players.”

The 34-page document is available to all and can be found here. Both the requirements for operating a crypto asset business, exchange or custodian and the regulatory framework for crypto assets are explained in detail in the document

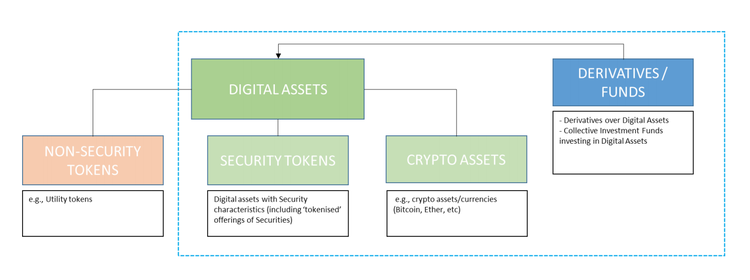

The image below shows the FSRA’s regulatory approach in relation to different types of digital assets.

These regulations, however, do not apply to initial coin offerings (ICO), since regulations for ICO's were issued last year.