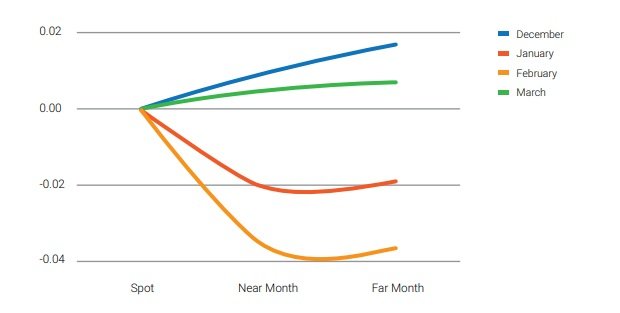

The Bitcoin (Bitcoin) futures curve is effectively flat and in a backwardation state for most of Q1, Element Group advisory firm states in a new analysis.

The company has reviewed trading patterns ranging from Bitcoin’s first future trade in December 2017 to market movements as of the end of March 2018, with some data reaching as far as early April 2018.

“The majority of futures trading today is likely being done for hedging and risk management purposes, rather than for speculation. The analysts also believe that market makers who take on the other side of a speculator shorting futures have a desire to be paid for that risk, given Bitcoin's high volatility. This payment for risk will usually show up as a deep discount to spot,” the paper says.

According to the research, last December was “a monumental time for major Bitcoin naysayers.”

“Those with deep pockets and even deeper stomachs for the margin risk had the chance to put their money where their mouths were. They finally had the opportunity to express a short position in the price of BTC with a listed product on two major exchanges. We believe this occurred, to a large extent, in the first month of the futures’ existence”.

The paper says that the dealers are positioned long, while leveraged funds and, to a lesser extent, asset managers are positioned short.

“This dynamic is important because those dealers are likely positioned long because they are taking the other side of a short trade by a leveraged fund. They are also probably market neutral, which means they need to hedge their exposure. To hedge their long futures position, they likely sold or shorted BTC underlying. This added supply to the marketplace. On the other hand, the leveraged funds are sitting short by a fair margin. This short interest creates discounts in pricing from fair value,” researchers say, noting that this discount in pricing will probably continue for the foreseeable future.