Chart analyst with Goldman Sachs (NYSE: GS) Sheba Jafari predicted in his Sunday’s report that Bitcoin (Bitcoin) would reach $4,827, and then loose almost half of its value, dropping down as far as $2,221, CNBC reported.

Indeed, Bitcoin’s price topped a record of $4,300 on Monday, gaining almost $1,000 to its rate one week ago. It was still lacking some $500 to reach the level of Sheba Jafari’s estimation.

However on Tuesday the cryptocurrency’s price went down 1.28% settling at the level of $4,282.77

According to Mati Greenspan, an analyst at trading platform eToro, this could be accounted for by investors taking some profit after the rapid rise of the crypto currency which just hit a record of $70 billion in its market cap, which was above the market evaluation of PayPal.

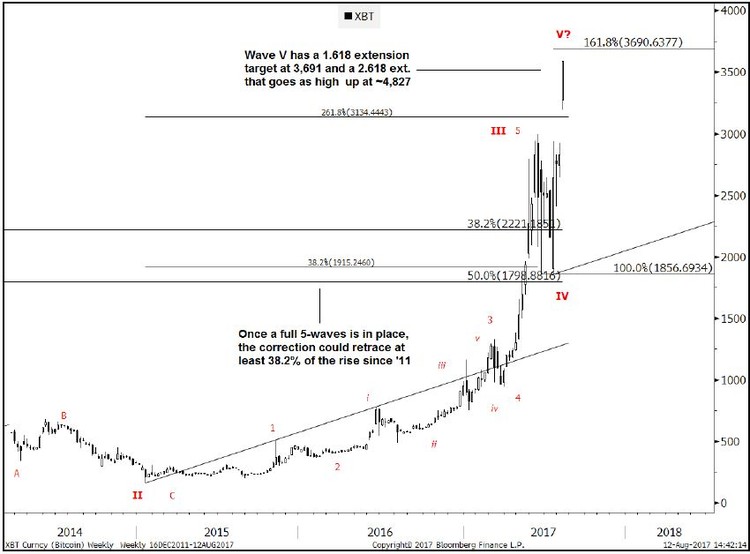

According to Goldman Sachs’ Sheba Jafari report the digital currency was riding a fifth wave of the continuous rally and when “a full five-wave sequence” is complete, “the market was expected to enter a corrective phase”.

"This can last at least one-third of the time it took to complete the preceding advance and retrace at least 38.2 percent of the entire move,” he added in the report. Thus, bitcoin will need to fall under $2,935 "to signal that a top is already in place," the report said.

Meanwhile, a longtime stock researcher and founder of Standpoint Research Ronnie Moas advised his clients on Monday after Bitcoin’s price cruised through $4000 that its rise will continue at least up to the benchmark high of $7,500.