Goldman Sachs Group Inc. (NYSE: GS) won a lawsuit against its own client and sent U.S. Marshals to a West Palm Beach marina to seize a yacht ‘Natita’ from one of its prized clients — billionaire Texas oilman William Kallop, who took a loan from Goldman Sachs in 2014, The Wall Street Journal reports.

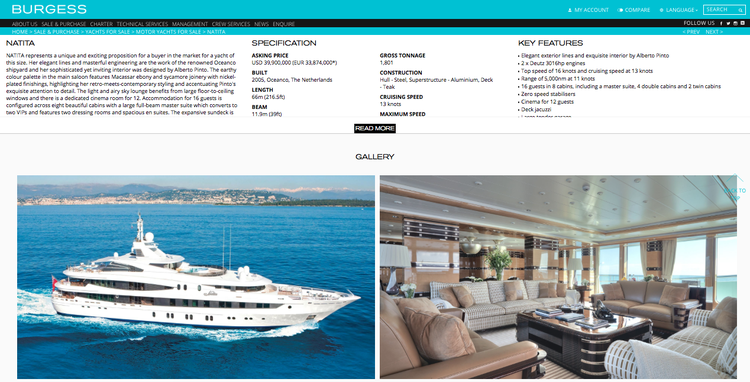

The yacht ‘Natita’ is listed for $39.9 million and it has a movie theater, Jacuzzi and helipad.

Goldman will most probably auction “Natita,” which has spent two years on the market with no takers.

It should be noted that lending to wealthy clients is Wall Street’s latest gold rush. Such loans grow quickly at firms such as Goldman, Morgan Stanley (NYSE: MS) and UBS Group AG (NYSE: UBS), because they have the added benefit of building loyalty among prized, ultrawealthy clientele.

Banks pushed wealth lending in recent years against a backdrop of increasing deposits and tepid demand for traditional loans.

Goldman’s private bank lending balances has grown four times since 2012 up to $29 billion. Morgan Stanley wealth-loan balances are up 420% since 2012 to $74 billion.