After one of the worst first quarters in Bitcoin's (EXANTE: Bitcoin) entire history when market capitalization dropped by 59% - from 613 to 252 billion dollars, the overall market value for cryptocurrencies rapidly decreased from above $800 billion to somewhere around $300 billion today. But crypto enthusiasts anticipate a more positive trend in the second quarter and the rest of the year.

Cryptocurrency expert Brian Kelly sees Bitcoin rebounding from recent losses and possibly bouncing back to early-year highs, saying that cryptocurrencies usually perform better in the second quarter.

"There will be a significant rally here if seasonality brings tail winds, " the founder of Brian Kelly Capital recently said, adding that tax-selling season, which pressured prices at the end of the first quarter is now winding down, and second, regulatory fears that squeezed cryptocurrencies since the beginning of the year are beginning to fade.

"We've gone to the extreme of the regulation which is South Korea thinking they're going to ban it, the U.S. talking about everything being a security, to walking it back," he explained.

True, government regulation is affecting the industry development tremendously across the globe and will be one of the major trends for the rest of 2018, according to another expert, Natan Avidan, CEO of Orca Alliance, an EU-based open banking platform for cryptocurrency users. He actually singles out three major trends for cryptocurrencies this year.

1. Cautious Interest

After a skyrocket rise in Bitcoin’s price last year many local governments and industry key players took a closer look at this new and promising market. Their first reaction in many cases was rather negative.

Like billionaire investor Warren Buffett who called Bitcoin a bubble and warned that coin offerings will end badly. “You can’t value Bitcoin because it’s not a value-producing asset,” Buffett said in October 2017.

He was supported by Ray Dalio, the founder of the world's largest hedge fund Bridgewater Associates and by Jamie Dimon, chief executive of JPMorgan Chase & Co (NYSE: JPM), who called the cryptocurrency “a fraud”.

Speaking at a bank investor conference in New York, Dimon said, “The currency isn’t going to work. You can’t have a business where people can invent a currency out of thin air and think that people who are buying it are really smart.”

Besides, many governments reacted quite aggressively to the new big thing in tech and finance. China’s central bank the People’s Bank of China proclaimed initial coin offerings (ICOs) illegal and demanded all related fundraising activity to be halted immediately. Chinese Bitcoin exchanges were ordered to stop all trading from September 30 which also affected the Bitcoin’s price.

South Korea’s Financial Services Commission also banned all forms of cryptocurrency-based money raising activity and threatened to ban cryptotrading altogether.

But later the South Korean government softened its stance, saying that the country’s authorities will focus on making cryptocurrency trading transparent rather than outlawing it altogether.

Even JPMorgan Chief Executive Jamie Dimon changed his attitude towards cryptocurrencies, saying: “The blockchain is real. You can have crypto yen and dollars and stuff like that. ICO's you have to look at individually. The Bitcoin to me was always what the governments are gonna feel about Bitcoin as it gets really big, and I just have a different opinion than other people.”

J.P. Morgan partnered with Royal Bank of Canada and Australia and New Zealand Banking Group Limited to launch the Interbank Information Network (IIN) which uses blockchain technology to reduce friction in global payments.

Many countries have already claimed they are considering their own crypto-projects. Not long ago 22 European countries signed a declaration on the establishment of a European Blockchain Partnership. The partnership will be a vehicle for cooperation between member states to exchange experience and expertise in technical and regulatory fields and prepare for the launch of EU-wide blockchain applications.

Only several days ago world leaders met for a G20 summit in Argentina and discussed cryptocurrencies. “There were some calls for crypto regulations, but the Financial Stability Board, backed by numerous delegations, put its foot down, saying more monitoring is needed before drafting any kind of regulation,” Natan Avidan says. “Plainly put, global leaders have taken a closer look at the underlying distributed ledger technology and realize they need to do more research before taking action. The current course is to proceed with a do-no-harm approach, and that’s a good thing,” he concludes.

2. Less scam ICOs

Just yesterday Yassin Hankir, the founder and CEO of Frankfurt-based startup Savedroid, published a tweet after a successful Initial Coin Offering:

Thanks guys! Over and out ... #savedroidICO pic.twitter.com/PMRtjlbEdD

— Yassin Hankir #savedroidico (@YassinHankir) April 18, 2018

He tweeted this just after his company collected about $50 million through a combination of an ICO and private funding. During the ICO Savedroid has raised funds from 35 000 backers who used 59 different cryptocurrencies.

After 24 hours of panic and a lot of questions from furious investors CEO Yassin Hankir has recorded a personal message to resolve the situation.

Hankir explained that he wanted to show how easy nowadays it is to run ICO, collect money and disappear with it even in a strictly regulated cryptomarket like the one in Germany.

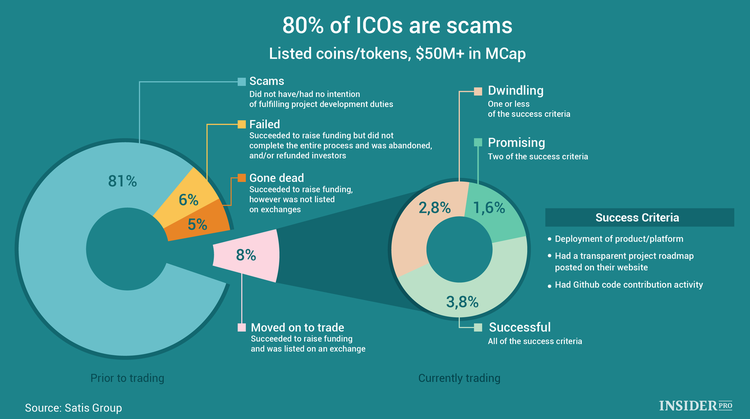

According to a study conducted by Satis Group, the premier ICO Advisory Group, 81% of ICOs are scams, and only 1.8% of them are promising. The group classified initial ICOs with market capitalizations of at least 50 million USD by quality, following an ICO’s evolution from white paper and fundraising to eventual trading online.

ICOs took off in 2017. This relatively new fundraising method has captivated companies ranging from startups to large-cap enterprises. The cryptocurrency craze last year led to over $5 billion in fundraising from a little more than 700 ICOs. The top ten ICOs by funds raised in 2017 generated a total of more than $1.74 billion.

“The reverse side of those statistics are pretty alarming: In February 48% of ICOs drew in 10% or less than their announced hard cap. And the 10 biggest projects only raised 46% of their cap. Crypto startups now need significant resources to stand out in the sea of mediocre projects fighting for community attention. Having a template-based landing page is not enough anymore,” Natan Avidan says.

3. Crypto-promoters need new strategies

This has resulted in a zero-tolerance policy towards ICOs from the main online platforms. Facebook has restricted crypto-related adverts. The social network has said it is banning all ads related to cryptocurrencies in an effort to fight scams.

“We’ve created a new policy that prohibits ads that promote financial products and services that are frequently associated with misleading or deceptive promotional practices, such as binary options, initial coin offerings and cryptocurrency, Rob Leathern, Facebook Product Management Director said, in a statement.

Twitter followed suit and started to ban users who solicit cryptocurrencies and/or promote ICOs in their tweets.

Google also announced that it is going to ban all ICO and cryptocurrency ads starting from June 2018. These new policies ban adverts for binary options and "cryptocurrencies and related content (including but not limited to initial coin offerings, cryptocurrency exchanges, cryptocurrency wallets, and cryptocurrency trading advice).

“The end result of these moves is hard to estimate, but they are going to make it increasingly hard for new projects to build communities and get traction in order to launch an ICO. Projects will have to be more creative in finding ways to grab public attention, and we should see decentralized forums such as Reddit, BitcoinTalk, and blockchain-oriented discussion boards gaining popularity as a result,” Natan Avidan says.

“The current pessimism could hold through the remaining three quarters of the year, or we could see the bulls make a comeback. It’s hard to predict. What we can be pretty sure about is that this will be the year in which regulators get a better grip on how to approach crypto and in which crypto projects need to be a lot stronger and more innovative to get off the ground,” the CEO of Orca Alliance, concludes.

By Jade Olafson