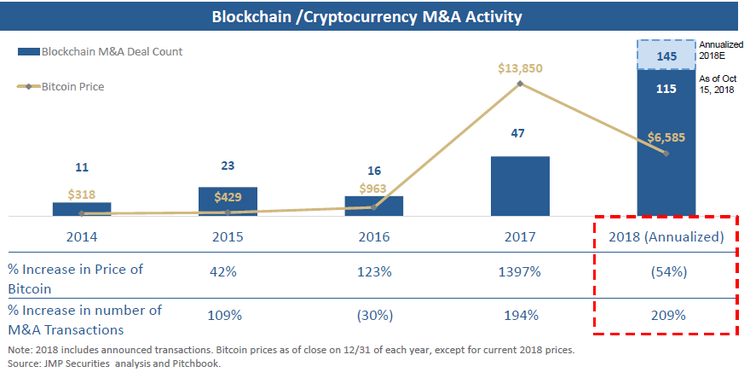

This year’s Bitcoin 54% price slump has opened the record high demand for the companies involved in the blockchain. The amount of merger and acquisition (M&A) deals signed in 2018 spiked 200 percent, PitchBook report compiled by JMP Securities says.

As of Monday, the number of such deals conducted this year amounted to 115 and is expected to reach 145 before 2019 starts. Just to compare, last year only 45 deals were signed, and back then the price of the first crypto was trading around $20,000 per bitcoin.

The researchers do not operate the exact numbers that would indicate the sizes of all the deals since some of them remain private and the whole information is not unveiled. However, after analyzing the data from the majority of investments, partial liquidation, and full acquisitions they came to a conclusion that most of M&A deals were signed internationally and were "relatively small" averaging less than $100 million.

The projects presented with a big number of assets on cryptocurrency market with prices still connected to the rate of the first crypto while their actual value is pretty high are a tasty morsel to be hunted at this stage.

Satya Bajpai, JMP Securities' Head of blockchain and digital investment thinks that there is a huge difference between the value and the valuation of such companies. That’s why investors prefer to expand their funds with the expectation of achieving a profit at an early stage or to buy them during the “discount period”, which actually happens now.

"You're seeing a mispricing of assets. Even for great businesses, the value of the token remains correlated to bitcoin, which can create an ideal opportunity for strategic acquirers", – he said in the interview to CNBC.

According to Bajpal, big companies who lost the time to create something of their own, are now forced to buy the projects that have a product that works or is about to work, as they already are out of time to start their own products from the beginning.

"It's expensive, but you get the technology and product immediately. This industry is like a treadmill — the only way to keep up on a treadmill is to keep running by investing in new technology", Bajpai said.

Bajpai, who specializes in advising the early stage companies or boards on M&A transactions points to other reasons that might stay behind such acquisitions. One of them is to bring new specialists who have both business and technical backgrounds. Another reason to go into an expensive absorption is to buy a company to attract its audience.

With more and more startups preferring to go through ICO the investors who would mostly choose to buy an equity stake in the new company are left only with the chance to become a token holder and to invest so-called “blindly”, without seeing the final product.

"As soon as a company becomes interesting, they get bought — the deal size may still remain small, but the number of deals will increase because that's the most viable and fastest way to grow in this environment", — Bajpai said.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.