Latest research coming from the University of Stirling in the UK, revealed that a surprising number of people have problems with evaluating financial deals as they (unknowingly) misinterpret the downside financial risks data, that is expressed in percentages.

This leads to people taking higher risks and losing more than they expected. The original research coming out in September's issue of the Judgment and Decision Making Journal has analyzed a group of around 3,500 people that were given 5 financial problem to solve.

One particular problem saw the highest number of mistakes, with only a third of participants getting the answer right. Most participants assumed that when they lose 50% of a total sum of money they have, they need the same 50% to restore the total amount. And this is not correct, says the researcher Philip Newall.

"Only investors who understand the asymmetry between positive and negative percentage returns can rationally process this information. Many investors are instead likely to assume that returns of +50% and –50% cancel out," wrote Newall.

Unfortunately, most people find this confusing but as it can significantly affect your finances, it's definitely not something to ignore. So, if you lose 50% of the total sum of 100£, you need 100% of the current amount, which is 50£, to make it 100£ again, and not 50%, which would only be 25£.

Logic is not the main factor

In line with these findings, Bloomberg has discussed another research that analyzed people's financial behavior and revealed that we are not making financial decisions as logically as we think.

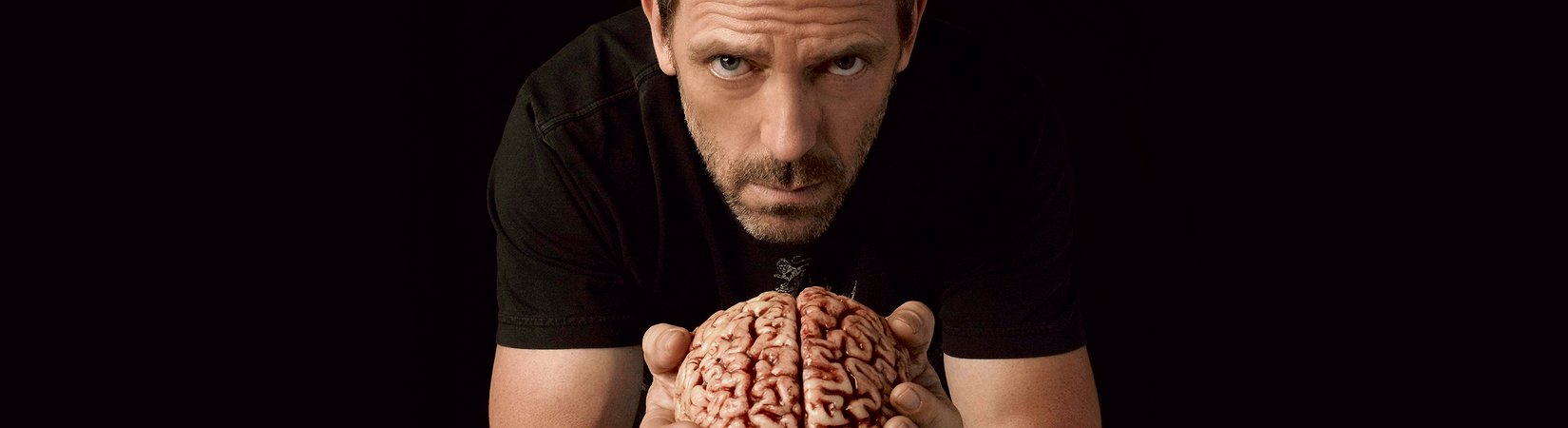

The researchers found out that, in fact, when placing a trading bet, people don't use the part of the brain responsible for logic and reasoning but the part that is more similar to what we call the "gut feeling". Guessing based on what your gut feeling tells you has far bigger impact on a trader's decision-making processes than was previously assumed.

The researchers of the California Institute of Technology have used scans to analyze people's brain activity while they were evaluating stocks. Using the brain scans, researchers could say exactly which parts of the brain were activate during trading.

Interestingly, the activity they noticed was not coming from the part of the brain that is active when we solve a mathematical problem using our logic. In turn, it was the part of the brain that the researchers called "theory of the mind". It is active when we make sense of the world and try understand or "read" other people, unintentionally predicting their future actions or emotional reaction. It is slightly similar to intuition.

In another experiment researchers came up with the similar results and concluded that participants who were better than others in predicting stock prices, also performed better in the experiments testing the "theory of the mind" abilities.

And yes, experts say that these abilities can be trained. They are part of human's emotional competencies and located in the paracingulate cortex of the brain.